Below is a report by The Globe and Mail on B.C. container terminal capacity.

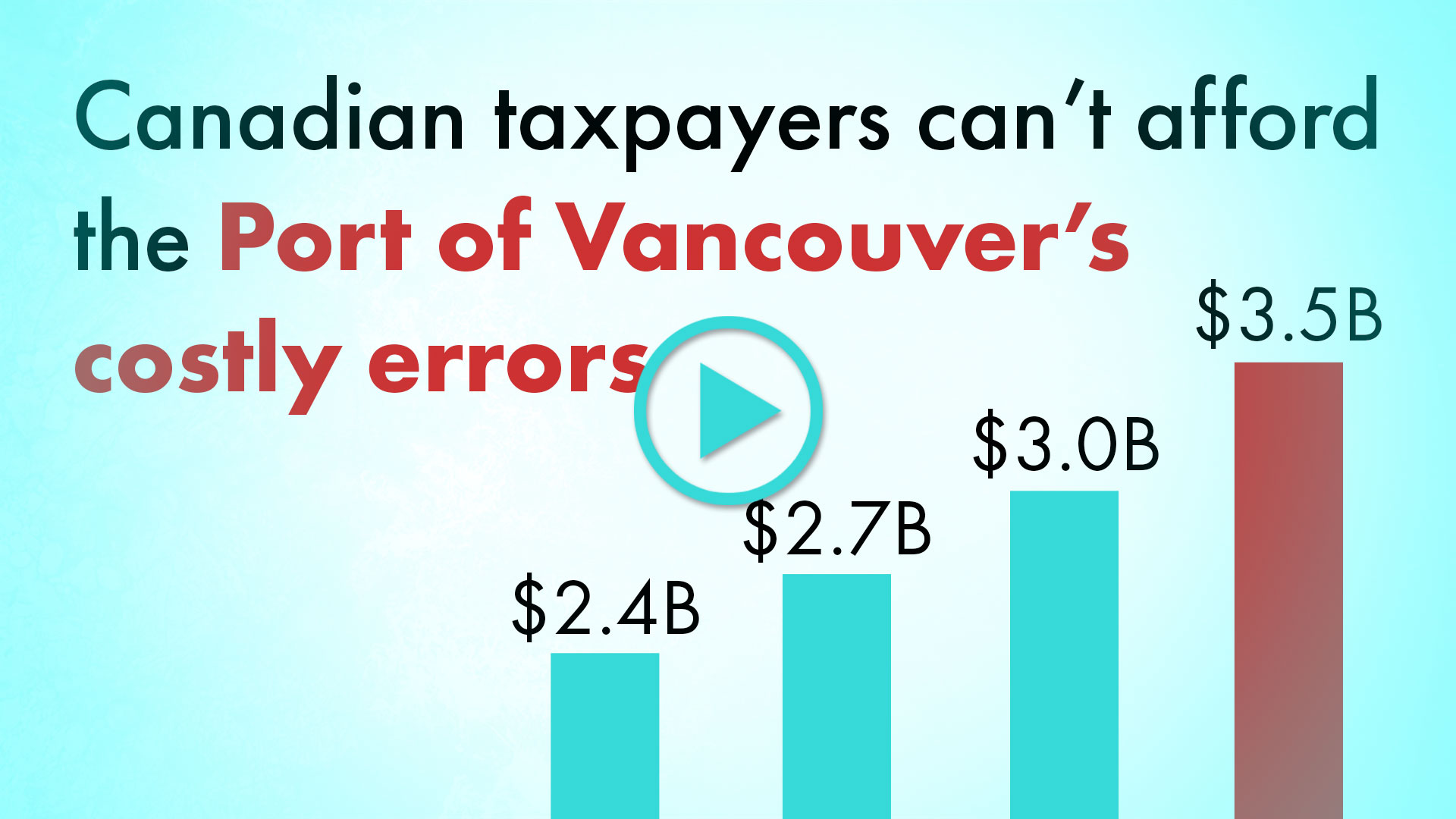

Unfortunately, the Port of Vancouver’s Roberts Bank Terminal 2 (RBT2) will cost more than $3.5 billion and, according to Environment and Climate Change Canada, will cause "permanent, irreversible, and continuous" damage to the environment to address a problem (container terminal capacity) that does NOT exist.

The Port of Vancouver’s forecasts were wrong in 2010 and they continue to be wrong in 2020. Lots of container capacity is being added in Vancouver and in Prince Rupert - 1.2 million TEU of new capacity by 2025 on west coast of Canada - plus GCT’s Deltaport Berth 4 expansion project slated for 2030 will add 2 million TEU. Learn more about the best way to incrementally add container capacity on Canada’s west coast by visiting our home page.

Port of Vancouver sends record numbers of empty shipping containers to Asia

Brent Jang, Globe and Mail

September 29, 2021

Expanding Vancouver’s port capacity could provide some relief, but efforts to do so are still months or years away from producing results.

Mr. Silvester is hoping the federal cabinet will rule by the end of March on the Port of Vancouver’s plans for a new $3.5-billion container terminal to be located near Delta, B.C., about 30 kilometres south of Vancouver.

The port is touting the project, called Roberts Bank Terminal 2 (RBT2), as a crucial expansion of shipping-container capacity on the West Coast to meet an anticipated increase in trans-Pacific traffic, including imports of consumer goods from Asia.

RBT2 would require construction of an artificial island near an existing coal-export terminal and shipping-container site. “The reason we’re moving RBT2 forward is we did a thorough analysis and have done a huge amount of environmental work over the course of 10 years. And it continues, based on all that work, in our view, to be the best opportunity to create critical capacity for Canada,” Mr. Silvester said.

Even with the Centerm expansion underway, the Port of Vancouver’s administrators are worried that Canada’s West Coast will run out of space to handle additional container shipments as early as 2025. “That’s actually kind of scary, because we can’t create capacity that quickly,” Mr. Silvester said. “So it really just underlines the importance of getting [RBT2] to move forward and creating that capacity. Otherwise, Canada is running out of capacity for containers, and that’s a problem for all of us.”

RBT2, however, is facing opposition from one of the port’s own tenants, GCT Global Container Terminals Inc., which runs an existing shipping-container site near Delta.

While the port’s hope is to open RBT2 in 2030, GCT has argued that its proposed Deltaport 4 expansion, which would add a fourth berth to its own facility, is a much better solution for supplying extra container capacity in the long term.

GCT has forecasted a total cost of $1.6-billion to add two million TEUs of annual container capacity at its facility. RBT2 would add 2.4 million TEUs for more than twice the estimated price.

GCT’s proposal is undergoing a review by the Impact Assessment Agency of Canada and the B.C. Environmental Assessment Office.

The Port of Vancouver is the landlord for container terminals at DP World’s Fraser Surrey Docks operation and GCT’s Vanterm facility. In Prince Rupert, DP World operates the Fairview container site.